Refreshing an icon

MAKE LIQUOR GREAT AGAIN

“WA—we've got better taste. And a coastline that doesn’t smell like commuter sweat.”

While the East Coast fumbles around with corporate red tape, large chains cannibalising the market, and every second salesperson claiming to have “disrupted” the rosé category, out West we’ve been quietly getting on with it.

Liquor Barons: Built Different

No buzzwords, no bullsh*t. We sell booze. And a lot of it.

Call it what it is:

When you see Liquor Barons, a sophisticated, nimble and entrepreneurial liquor retailer, making noises louder than the big nationals ever could, you’ll think, I wish I made the move sooner.

We are a ruthlessly consumer-led, locally-owned operation that sells smarter, operates better, and still manages to make it to Sunday footy.

Editor’s note

Welcome to the June–July edition of National Liquor News, where we spotlight the resilience, innovation and evolution shaping the independent retail liquor sector.

Leading the issue is our annual Banner Groups feature, which dives deep into how banner groups are helping independents navigate challenging market conditions. Whether it’s digital innovation, targeted marketing, omnichannel growth or new infrastructure, these groups are investing in longterm sustainability and helping their members compete smarter. We spoke to leaders from ILG, Liquor Legends, IBA, Thirsty Camel Victoria, Paramount Retail and LMG to explore how they’re delivering scale, support, and community connection – all while preserving the local identity that makes independents so valuable.

Also in this issue is our inaugural American Whiskey Buyer’s Guide, presented in partnership with the Distilled Spirits Council of the United States (DISCUS). This exclusive guide is designed for Australian drinks professionals and showcases 68 outstanding whiskeys from across North America – from time-honoured distilleries to rising craft producers – along with expert

insights into key styles, flavour profiles and sourcing opportunities.

We’re also helping to celebrate a major milestone – ILG’s 50th anniversary! To mark the occasion, readers can enter our special quiz for the chance to win a cellar door experience in South Australia. It’s a fantastic way to recognise ILG’s legacy of collaboration and support in the industry. Turn to page 56 to find out how to enter.

In other news, Drakes Cellars has officially launched across six South Australian stores, signalling a bold new chapter in independence and local engagement, supported by Paramount Liquor. Paramount is also expanding its dual-banner strategy, unveiling its first fully rebuilt Bottle Stop store in Newport – a sleek, tech-forward retail space designed with convenience and community in mind.

Enjoy the read!

Cheers, Deb

Deb Jackson, Managing Editor 02 8586 6156

Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton [email protected]

Managing Editor: Deb Jackson [email protected]

Senior Journalist: Molly Nicholas [email protected]

Journalist: Sienna Martyn [email protected]

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams [email protected]

Group Art Director –Liquor and Hospitality: Kea Webb-Smith [email protected]

Prepress: Tony Willson [email protected]

Production Manager: Jacqui Cooper [email protected]

Subscription Rates

1yr (11 issues) for $70.00 (inc GST) 2yrs (22 issues)for

To subscribe and to view other overseas rates visit www.intermedia.com.au or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: [email protected] FOOD & BEVERAGE

Top prize – an amazing cellar door experience, including flights, accommodation and spending money

Celebrate ILG’s 50th anniversary and test your knowledge of the liquor landscape.

[yellow tail] reveals new look with modernised branding

For the first time in more than 20 years, iconic wine brand [yellow tail] has unveiled a major brand refresh backed by significant global investment.

In 2024, for the seventh year running, [yellow tail] was named the Most Powerful Brand by the International Wine and Spirits Record – an achievement determined from data representative of more than 378 million wine drinkers across 18 countries.

When [yellow tail] wine first burst onto the scene in 2001, it quickly rose to prominence thanks to its fresh take on branding, which has continued to differentiate the brand in a market as traditional as wine. At the time, the iconic Roo logo and vibrant label symbolised a more relaxed wine culture and made wine more accessible to a broader demographic.

More than 20 years later, [yellow tail] has announced its biggest brand refresh since its launch – a new look designed to refresh its image, enhance its market relevance and drive long-term growth. With significant global investment, the major packaging revitalisation will ensure that [yellow tail] remains the first choice for consumers worldwide.

The refreshed [yellow tail] packaging continues the brand’s legacy, while embracing a modern feel and showcasing the quality and personality of the wine. The new look also reflects [yellow tail]’s continued commitment to innovation, with releases like its Sparkling Cocktails Mediterranean Lemon Spritz.

Arina Serra, Global Senior Brand Manager for [yellow tail], said: “Our updated packaging is more than just a fresh look; it reflects our evolution while reaffirming our commitment to quality and approachability. We’ve retained the elements that our consumers love while refining the details to create an even stronger visual impact on the shelf.”

Big on taste, light on everything else

From May 2025, [yellow tail] Pure Bright has transitioned to Light & Bright. This new branding clearly communicates the range’s benefits, focusing on lower alcohol content. The fresh, contemporary packaging stands out from the [yellow tail] core range while maintaining a family resemblance.

The transition will be supported by an ATL campaign featuring Australian brand ambassador, Sophie Monk. In the campaign, Monk embodies the essence of Light & Bright with her signature downto-earth humour.

Chris Blockley, GM of Sales, said: “2025 is shaping up to be an exciting year for the brand. With our refreshed packaging, ongoing collaboration with Sophie Monk, and dedication to innovation, we’re confident our investment in the brand will strengthen our connection with customers and consumers in a competitive price category. Our commitment is further demonstrated through ongoing investment in ATL advertising, along with various customer and consumer-focused activations and support throughout the year.”

The new [yellow tail] packaging has now launched in Australia across the core range. For more information on the [yellow tail] range, contact your Casella representative. ■

Key features of the new packaging include:

• A sleek, contemporary design that appeals to all demographics.

• Bold packaging that stands out on shelves and simplifies consumer choice when navigating the wine category.

• Enhanced graphics and labelling, making it easier to identify varietals and flavours.

• Premium details that elevate the branding.

• A revitalised Roo design that embodies [yellow tail]’s lively and energetic brand personality.

• A gold Roo design and new cork closure for the Sparkling Cuvée range, enhancing the premium nature of the product.

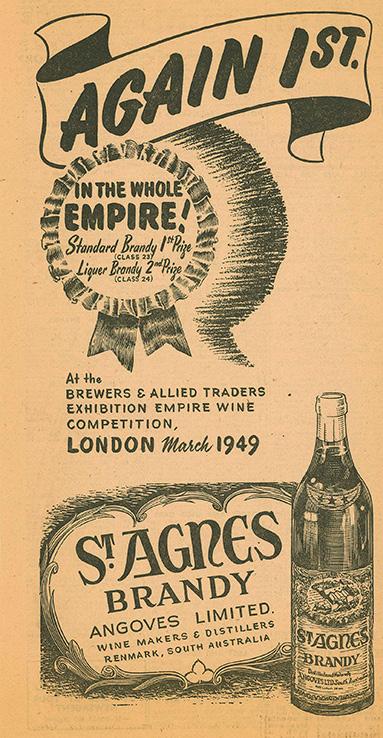

St Agnes celebrates 100 years with release of Australia’s oldest bottled spirit

St Agnes Distillery has marked the historic milestone of its 100th distilling season with the limited release of St Agnes XXO 50 Year Old Exceptional Reserve.

Australia’s oldest family-run distillery St Agnes Distillery is commemorating a major milestone in 2025 – its 100th distilling season – solidifying its status as a pioneer in the country’s premium spirits industry.

Founded in 1925 by Carl Angove, St Agnes has grown from humble beginnings into a cornerstone of the Australian spirits industry. Now helmed by the fifth generation of the Angove family, the distillery continues to blend time-honoured traditions with modern innovation, earning international acclaim for its range of brandies.

Richard Angove, co-Managing Director of St Agnes Distillery, shared his excitement with National Liquor News, highlighting just how much of an achievement it is for the distillery to reach its 100th distilling season.

“This milestone reflects the dedication, skill, and passion of generations of distillers who have worked tirelessly to craft exceptional brandy right here in the Riverland.

“We’re proud to honour our legacy while embracing what’s next for Australian spirits. Our commitment to hard work, tenacity and craftsmanship remains as strong today as it was a century ago.”

To celebrate the momentous milestone, St Agnes Distillery has

unveiled St Agnes XXO 50 Year Old Exceptional Reserve, the oldest bottled spirit ever produced in Australia.

Crafted from parcels of brandy distilled between 1953 and 1972 and aged in Riverland barrel halls, St Agnes XXO 50 Year Old Exceptional Reserve honours five generations of distilling excellence.

Angove describes the release as the pinnacle of the distillery’s century-long pursuit of greatness.

“When my grandfather Thomas Angove decided to distil incredibly small parcels of exceptional spirit, he wasn’t thinking about today or tomorrow – he was thinking decades ahead.

“He believed this spirit had the potential to become something truly exceptional, and that’s exactly what happened. We’ve watched and waited, allowing time to do its work, and have been rewarded with an incredible spirit that we can’t wait to share.

“It’s more than just a brandy – it’s a reflection of everything we stand for. This release is both a tribute to the last 100 years and a toast to what’s still to come.”

With just 500 bottles available, the release sets a new benchmark as the most expensive Australian spirit with a price tag of $4,800.

“We’re

proud to honour our legacy while embracing what’s next for Australian spirits. Our commitment to hard work, tenacity and craftsmanship remains as strong today as it was a century ago.”

Richard Angove

A century of distilling excellence

The distillery’s milestone follows a standout year in 2024, during which it was named Champion Australian Distiller at the Melbourne Royal Australian Distilled Spirits Awards. St Agnes also secured Best Distilled Spirit accolades at the Royal Sydney, and Royal Australian Spirit Awards, alongside Best Brandy trophies at every major capital city competition. International recognition came in the form of gold medals at the Hong Kong International Wine & Spirit Competition.

While best known for its brandy, St Agnes continues to push the boundaries of Australian distilling with a diverse portfolio that includes Blind Tiger Organic Gin and the award-winning Camborne Whisky.

With its centenary celebrations continuing to unfold throughout 2025, St Agnes Distillery is poised to reinforce its reputation as a leader in Australian spirits – honouring its past while embracing the future. ■

St Agnes

Changing the way consumers consider Australian wine

Occasion-based consumption trends are at the heart of a new campaign designed to celebrate the quality and diversity of Australian wine.

Recent insights from the IWSR Australian Wine Landscapes Report (2024) show that the domestic wine market has changed. The regular wine-drinking population is shrinking, making it imperative to attract new drinkers to the category and ensure regular wine drinkers are choosing Australian wine on more occasions.

The research shows that there is a valuable opportunity to engage with consumers interested in learning more about wine, notably Gen Z and Millennials, who are adventurous, socially engaged, and high average spenders in both on- and offpremise settings.

This changing landscape has shaped the direction of Wine Australia’s new ‘We make a wine for that’ campaign, designed to align Australian wine with everyday moments and make it the beverage of choice for a wider range of consumption occasions. For trade outlets, it’s an opportunity to make wine

feel more approachable as part of an occasion.

With over 100 grape varieties grown across 65 wine regions, the campaign spotlights the quality and diversity of Australian wine, which offers domestic shoppers a perfect bottle to match any consumption occasion.

Paul Turale, General Manager Marketing of Wine Australia, says: “The campaign is built around the premise of connection, celebrating relationships and moments that matter.

“Through this campaign we celebrate the diversity of occasions that define today’s culture and give shoppers confidence that there really is no need to look any further than Australia because ‘we make a wine for that.’”

Targeting category share from imported wines and other competing alcohol categories, the campaign is an effective and affordable way for the sector to increase domestic sales and engagement and attract new drinkers.

“Through this campaign we celebrate the diversity of occasions that define today’s culture and give shoppers confidence that there really is no need to look any further than Australia because ‘we make a wine for that.’”

Building momentum around the campaign “Wine consumption is declining globally, driven in part by less-involved consumers leaving the category and increased competition from other alcoholic and non-alcoholic beverage categories,” explains Turale.

“The campaign aims to get adults who have some level of awareness of wine to choose Australian wine more frequently for more occasions, which will in turn drive sales of Australian wine and benefit the whole sector.

“From well-loved classics to innovative and emerging styles that are shaping the look, feel and taste of modern Australia, there is always something new to discover about Australian wine,” he continues.

To grow domestic market share, Turale is calling for a collective industry approach, where the sector adapts and meets consumers where they are.

“Sector collaboration will be critical, as we work

together to give this campaign momentum. A strong and consistent message needs to be visible across the path to purchase journey for wine drinkers to ensure cut-through,” he continues.

To ensure a unified national message across all elements of trade, Wine Australia will provide resources and support for retailers, wineries and onpremise venues.

A free marketing campaign toolkit will be available on the Wine Australia website from June, with templates, assets, and messaging to help to bring the concept to life across all customer touchpoints.

With consumer rollout beginning in August, Turale encourages retailers to look for opportunities to align the campaign with Australian wine category activities to increase relevance, share of voice and category awareness in a crowded market.

“We’re inviting retailers and trade to engage through social media, catalogues, in-store POS, tastings, PR and events. The campaign is flexible so they can maintain their individual branding and point of difference in the market.

“The impact with shoppers will be made if we can have consistent re-enforcement of the campaign messaging throughout the path-to-purchase journey, so that when they get to the shelf, they will choose Australian wine.”

Wine Australia will broaden the audience reach and engagement for campaign-related events by promoting them on its Australian Wine website, and retailers can also benefit from an umbrella media and digital campaign throughout the campaign period.

To sign up to the campaign, visit wineaustralia. com/wemakeawineforthat and gain access to downloadable campaign guidelines, social and POS assets, poster templates, creative activation ideas and the event submission portal. ■

Paul Turale, General Manager Marketing, Wine Australia

Who is shopping in your store anyway?

David Shukri, Customer Success Director at Shopper Intelligence, offers insights into consumer behaviour across each of the major banners.

Simple question, right? Well… maybe not.

I speak to plenty of people who can’t clearly articulate who’s buying (not consuming) their product – or why they’re buying it.

The interesting thing is, we often jump straight into category strategy to answer this question. And while that makes a lot of sense, it misses one important factor: the profile of the shopper at the banner level.

Every banner has a different shopper profile. What matters in one store might not matter in another. Miss this, and you risk misfiring at the category level.

So, here’s a topline look at who’s shopping in each of the major banners – and what matters most to them – to help you plan and collaborate more effectively with your partners.

Dan Murphy’s

The Dan’s shopper remains the most engaged. They’re open to spending more, but they’re demanding too, and one-in-three would walk away without buying anything if they couldn’t find their chosen tipple. This is often down to poor availability of key lines, or indeed, the perception that a product is unavailable.

This shopper still values competitive prices, even if they’re prepared to trade up, so the task is to lead with price and guide the way to premium trade-ups.

BWS

This is a shopper that’s feeling pressure on their budget. Like Dan’s, nearly a third are willing to leave empty-handed if they can’t find what they need. They’re calling out better store layout and better signage as two big opportunities, but they’d also like to see clearer value messaging and more visible offers.

Liquorland

Overall satisfaction here is lower than the market, with unclear pricing and inconsistent execution called out as key issues.

This is a shopper that will pick Liquorland if they see enticing offers pre-store, so tightening up marketing relevance is critical in the new Liquorland era. There’s also a job to do on EDLP, range simplification and in-store theatre to improve satisfaction and shopper retention.

First Choice

The banner is evolving, but what does that mean for its current shopper?

They’re loyal when the store delivers well and respond positively to volume-based trade-ups when the deal is right. They’re more open to new ideas than shoppers in many other banners, but price matters.

Focus areas include strong pre-store

value cues, clearer in-store signage, and better product information.

Bottlemart

The Bottlemart shopper is curious and open to premium trade-up. They care about quality, like to browse, and are interested in new products. However, layout, range, and availability need attention.

They’re more impulsive than the average off-premise shopper and this, coupled with the fact one-in-four is looking for the best deal on the day, means a great opportunity to dial up that ‘limited offer’ messaging in-store.

Cellarbrations

Finally, the Cellarbrations shopper tends to be less planned and more open to discovery when they’re in-store. They’re more likely to browse and will consider both premium and new products, so signage and information are crucial.

Given this shopper over-indexes younger (18–34) and female, decisions on range and marketing need to reflect that in order for Cellarbrations to thrive.

If you’d like to go deeper and understand which categories are best placed to drive growth banner by banner, get in touch: [email protected]. ■

https://theshout.com.au/national-liquor-news/subscribe

News

For retailers around the country

LMG and SipnSave celebrate 20 years as a joint force

Last month, Liquor Marketing Group (LMG) and SipnSave celebrated 20 years since the formation of the joint venture which brought the two groups together.

Established in 1977, LMG initially operated predominantly in New South Wales. Just two years later, SipnSave was launched in South Australia, and has been part of LMG’s national footprint since 2005.

Now, SipnSave has become one of South Australia’s largest independent packaged liquor groups, with 100 outlets throughout the state. Meanwhile, LMG proudly represents more than 1,400 independent operators in Australia’s retail packaged liquor sector and operates Australia wide.

LMG Director and SipnSave Chairman Tony Hurley said: “It is pleasing to reflect on the growth of SipnSave in a market where countless brands have come and gone. It is a testament to focus on creating value for members over the long term by supporting them and focusing on meeting the shopper needs which pays dividends in the form of brand equity.”

Oliver’s Wines eyes bricks-andmortar expansion with Tony Leon

Oliver’s Wines, the online wine information and retail platform created by internationally renowned wine critic Jeremy Oliver, is moving into bricks and mortar, in partnership with one of Australia’s leading liquor retailers, Tony Leon.

Having operated exclusively in the online space for just over 12 months, Oliver is focused on developing strategically placed and highly visible landmark stores tightly connected to the online platform. With Leon, whose stellar career includes taking Dan Murphy’s from a single store to 88, he is currently searching for the first physical location for Oliver’s Wines in Melbourne, with locations in Sydney and Brisbane to follow.

“A high-profile bricks and mortar presence can drive sales via our online platform in a way that is too hard to deliver when purely online,” says Oliver.

“But a physical multi-purpose operation featuring a wine bar plus event and education spaces will greatly help us create and nurture customer relationships. Visitors to our stores will discover our unique brand story and experience the depth and truly personalised nature of our online/offline presence.”

Oliver and Leon are united in their conviction that it’s the ideal time to offer a high quality and high value range from makers large and small, known and lesser known, supported by a strong emphasis on customer engagement, experience and service.

Tony Leon and Jeremy Oliver are searching for the first physical location for Oliver’s Wines.

ILG breaks ground on new Swanbank distribution centre

Independent Liquor Group (ILG) has marked a significant milestone with the sod-turning of its new distribution centre in Swanbank, Queensland.

The purpose-built facility, spanning 30,846sqm, will be located in the Swanbank Business Park, strategically positioned near Ipswich and Brisbane.

Once completed, the site will feature a custom-designed warehouse, dock office, material handling equipment (MHE) charging zone, and temperature-controlled zones – enhancing supply chain efficiency and strengthening ILG’s growing operations across Queensland.

Construction is now underway, with the site poised to become a key hub in ILG’s national logistics network. The Swanbank DC project is also expected to generate new employment opportunities and bolster economic activity in the surrounding areas, aligning with ILG’s mission to empower regional communities.

Paramount unveils Bottle Stop Newport

Paramount Retail has opened the doors to its first fully rebuilt liquor store, Bottle Stop Newport, marking a significant milestone in the group’s ambitious dual-banner growth strategy.

Bottle Stop is Paramount Retail’s convenience-led offering, and the new Newport store has undergone a complete transformation to reflect the group’s ambition to create modern, community-first liquor stores. With a focus on pricing, convenience and a tech-forward shopping experience, the store sets a new benchmark for the growing portfolio of physical stores.

Leigh Rowe, CEO of Paramount Retail, says: “Newport marks a pivotal moment for us. This is more than just a renovation – it’s a showcase of what our retail future looks like. We’ve built this store with the community in mind: sharp prices, smart design, and a welcoming experience that locals have already embraced.”

Drakes Supermarkets rebrands liquor division

Drakes Supermarkets is rebranding its liquor arm as Drakes Cellars, launching the new identity across six South Australian stores from 30 June. The stores, previously under the Cellarbrations banner, are in Aston Hills, Eyre, Findon, Gawler East, Mount Barker, and Wallaroo.

The move reflects Drakes’ focus on independence, family ownership, and strengthening local partnerships. Paramount Liquor has been appointed as the exclusive supply partner.

Drakes Director John-Paul Drake said, “At Drakes, we’re here for a good time and a long time... it’s like wine and cheese – a match made in heaven.”

Paramount Liquor Director Leigh Rowe added, “We’re both

family-owned businesses... this partnership is built on trust, shared ambition, and a clear goal.”

To mark the launch, Drakes Cellars stores will offer tastings from local producers, exclusive deals, and an enhanced online shopping experience at drakescellars.com.au.

Drakes operates 68 supermarkets nationwide, turning over $1 billion annually.

Your brand can reach up to 250,000+ trade customers across 6 national publications. Download

Zest is best

Bright, bold, and refreshingly tangy – citrus is having a major moment in the world of alcoholic beverages. Driven by a consumer craving for vibrant, fruit-forward drinks, citrus-based beverages are winning over a wide demographic. From allAustralian limoncello to citrus beers and RTDs, these are the standout products driving the citrus craze.

“We’re definitely seeing citrusbased spirits like our bestsellers, Limoncello and Coastal Citrus Gin, resonate with a new wave of consumers – especially younger drinkers and those seeking fresher, lighter flavour profiles. There’s a growing appreciation for premium, vibrant spirits that feel both approachable and crafted, which is drawing in everyone from cocktail enthusiasts to casual sippers looking for something distinctly coastal and refreshing.”

Adam Ballesty, General Manager, Manly Spirits

In the Hard Fizz US RTD Study Tour report, the brand identified the trends shaping the dominant RTD category across standalone liquor stores, convenience channels and supermarkets in the US. Within the vodka and tequila segments of RTD, Hard Fizz found that strong demand for citrus and tropical fruit flavours has led to increased shelf space and premium positioning.

Zesty spirits dominate sales for Manly Spirits

As more and more consumers reach for light, bright, citrus beverages, Manly Spirits says its Zesty Limoncello has become one of the top-selling Australian limoncellos on the market.

Crafted in small batches using hand-peeled lemons and infused with native botanicals like lemon myrtle and lemon aspen, the award-winning liqueur offers a zesty, lemon meringue tart finish that captivates consumers.

Manly Spirits Coastal Citrus Gin is another favourite among consumers, offering a distinct twist on traditional gin. Combining earthy citrus notes with delicate savoury flavours, it’s ideal for a classic G&T or a coastal-inspired cocktail. Distributor: Manly Spirits

In data gathered by Innova Market Insights, citrus flavoured RTDs grew at a CAGR of 91.1 per cent between 2019 and 2023. Deemed to be one of the most refreshing flavour profiles within the category, it was reported that 72 per cent of consumers preferred a citrus flavour profile when choosing which RTDs to purchase.

Citrus gin in a tin

Four Pillars launched its first RTD back in October 2021, and ahead of summer 2022/23, decided a citrus-based beverage was missing from the range. Along with the release of the popular Bloody Shiraz Gin & Tonic, Four Pillars added the Fresh Yuzu Gin & Soda to its RTD line.

Fresh Yuzu Gin & Soda was Four Pillars’ first RTD can that used soda rather than tonic as a mixer, with its low-calorie count making it an ideal choice for health-conscious consumers.

The highball style drink uses a concentrated Fresh Yuzu Gin base, with the extra yuzu offering a strong citrus flavour profile, combined with clean and crisp carbonated water for a refreshing finish.

Distributor: Vanguard Luxury Brands

“Citrus is the best-selling flavour profile currently, so having strong visibility and shopper disruption is key. You have to be easy to find and buy, with a range that’s easy to navigate. We know taste trumps all, so having authentic brand experiences in-store that bring flavour delivery to life via trial is integral.

Secondary touchpoints and stock weight on floor to attract attention would also be considered best practice.”

Felons barrel-aged brew bursts with orange zest

Felons Brewing Co. has unveiled the latest addition to its barrel-aged beer project, The Last Orange, a fruited golden sour blend bursting with fresh orange zest.

Crafted from a winter harvest of navel and blood oranges, The Last Orange is a combination of two golden sours, one from 2021 and another more recent, infused with fresh orange zest and aged for 26 months in Slavonian and American oak barrels.

Felons Senior Brewer, Jared Palu, says: “Barrel ageing is a process of precision, especially with citrus – The Last Orange required us to balance the perfect amount of contact time with citrus zest, boosted by fresh juice. It’s a beer of subtlety and intensity all at once, while still remaining fresh and fun on the palate.”

Distributor: Felons Brewing Co.

Albertus Lombard, Brand Director Spirits & RTD, Lion

Zoncello sparks a buzz across the country

First launched in February 2023, Zonzo Estate’s Limoncello Spritz Zoncello was initially available at the winery’s cellar door but quickly became a runaway success and reached independent retailers across the country.

Made with Zoncello Limoncello and Zonzo Estate Prosecco, the Spritz is fresh and bright with a gentle fizz and notes of lemon sherbert, described as being reminiscent of ice-cold sorbet. Zoncello has enjoyed great success, prompting the winemaker to expand its range of bottled spritzes to include Bellina and Cicchio Pistachio Spritz. As the market for citrus-flavoured wine spritzes grows, Zoncello remains a fan favourite and is now available in a convenient 200ml can format alongside the original 750ml corked bottle.

Distributor: Zonzo Estate

“Lemon is not a new flavour, and it is something that people are familiar with. Italians have been enjoying Limoncello and Limoncello Spritz for a very long time, and with lots of Australians travelling to Europe every Winter, they have become more familiar with these drinks, too. I think when we launched Zoncello, we made Limoncello Spritz more accessible. There is no need to purchase multiple ingredients and fiddle around with the perfect recipe – you can simply pop and pour, which is what you need when you are hosting.”

Rod Micallef, Director, Zonzo Estate

De Bortoli Limoncello Spritz caters to moderation

In the 12 months to June 2024, three out of the top six alcohol growth brands feature a citrus-based beverage in their ranges. Hard Rated was the top growth brand, with lemon featuring in every flavour variation. Closely following Hahn, Great Northern and Balter, was Kirin Hyoketsu and Brookvale Union, both of which have at least one lemon flavour within their range. Collectively, these six brands generated more than $500m in sales within the 12-month period, and Hard Rated alone generated $157m in Australia in 2023.

In 2024, De Bortoli Wines was quick to join the booming citrus market with the launch of its Limoncello Spritz, a refreshing ready-toserve combination of De Bortoli Prosecco and lemon flavours. With an ABV of nine per cent, Limoncello Spritz offers flavour to the growing number of consumers looking to moderate their alcohol consumption.

Although traditionally consumed as an aperitif, Limoncello Spritz is equally suited to a pre-dinner occasion, paired with a meal, or on its own. De Bortoli suggests elevating the experience by serving Limoncello Spritz with a sprig of fresh mint and a slice of lemon.

Distributor: De Bortoli Wines

“Retailers can build a stronger citrus offering by dedicating space in-store with clear cues around refreshment and ease. Grouping citrus-based beverages together would make navigation simpler and highlight their versatility. An occasion-based approach like casual entertaining or weekend drinks could also help drive engagement and purchase.”

Darren De Bortoli, Managing Director, De Bortoli Wines

“Citrus remains a crowd-pleaser, but today’s drinkers are after more than just familiarity — they want freshness with a story. We’re seeing strong demand for citrus profiles that offer a twist, especially when grounded in local provenance.”

Archie Rose grounds citrus in local provenance

Amplifying Archie Rose’s ethos of working with local, sustainable producers, the distillery’s annual vintage Harvest series acts as a true expression of the ingredients and provenance behind its spirits.

Citrus is front and centre in the 2021 edition of Lemon Scented Gum Harvest Gin. Spotlighting aromatic lemon scented gum grown by Cyan and Martin at Bunyip Hollow in Victoria, the gin offers aromas of lime sherbet and apple blossom with freshly squeezed lime on the palate, and a lingering finish dominated by barbecued lemon.

Trevor Hannam, Head of Sales at Archie Rose, says the Lemon Scented Gum Harvest Gin is a perfect example of a citrus profile grounded in local provenance.

“Uniquely Australian, vibrant, and delivering that crisp, elevated citrus experience with notes of yuzu, emerald green finger lime, pine, and eucalyptus,” he stated.

Distributor: Archie Rose Distilling Co

Grapefruit shines in Papa Salt Paloma

Since its launch in May 2023, Australian coastal gin Papa Salt has quickly established itself in Australia’s spirits market, and a little more than six months ago the brand introduced a refreshing new addition to the portfolio.

Packaged in a slim 250ml can at five per cent ABV, the Papa Salt Paloma debuted in October 2024 at SXSW Sydney and has captured demand for citrus-based beverages ever since its rollout to bottle shop shelves in November.

With just 99 calories and one standard drink per can, Papa Salt Paloma combines the award-winning Papa Salt Gin with Capi Grapefruit Soda, crafted using natural and locally sourced ingredients to ensure vibrant grapefruit flavours with a touch of rosemary.

Distributor: ICONIC Beverages

“We see demand for citrus-based drinks continuing to grow over the next 12 months, with bars and retailers backing the trend for refreshing, light, and natural options. Premium RTDs will keep booming too, think lower sugar, natural flavours, and better-foryou vibes are what people tell us they want and citrus-based hits the spot.”

Maas, CEO, Papa Salt

Trevor Hannam, Head of Sales, Archie Rose

Charlie

Marketplace

Brand news and promotions

36 SOUTH represents a bold new chapter in Australia’s spirits story

36 SOUTH is the bold new expression of Australian whisky crafted by Morris of Rutherglen and distributed by Casella Family Brands, a 100 per cent family-owned and independent company celebrated for its outstanding portfolio of Australian brands.

Recently crowned Best Australian Blended Whisky at the 2025 World Whiskies Awards, 36 SOUTH offers aromas of raspberry jam, toasted cereal and vanilla cream, and a palate of dried red fruits, lightly charred oak and honey-glazed pastry.

Capturing the essence of the Rutherglen environment, which is situated precisely at 36 degrees south latitude, the whisky is made with locally sourced wheat and barley. The region’s distinct climate is ideal for whisky maturation, and provides an enhanced aging process that results in a smooth, complex flavour profile unique to its origins.

Lara Gardner, Senior Market Manager, Spirits – Casella Family Brands, says: “Crafted with care at the historic Morris of Rutherglen and shaped by the unique climate of Rutherglen, 36 SOUTH Whisky embodies the strength, character, and innovation of Australian craftsmanship.”

Proudly crafted at the Morris Whisky Distillery in Rutherglen, Victoria, home to the Morris family since 1859 and Australia’s most awarded wine and whisky brand, 36 SOUTH Whisky is a celebration of craftsmanship and heritage. Distributor: Casella Family Brands

Four Pillars enjoys success with Navy Strength Gin in a tin

Modelled on the Ginger Mule cocktail – a gin-based adaptation of the popular Moscow Mule – Navy Strength Gin & Ginger is one of the leading SKUs in Four Pillars’ popular RTD range.

Made with a hyper-concentrated version of the Yarra Valley distilleries award-winning Navy Strength Gin, and a bespoke ginger beer, the canned cocktail has a high ABV of 6.5 per cent.

Crafted with real ginger and real finger limes, a hyperconcentrated Navy Strength Gin was distilled for use in the RTD to ensure none of the flavour was lost. The botanical load was increased to include more ginger, turmeric and finger limes, then paired with Four Pillars’ own ginger beer. The result is a super fresh gin drink with a hint of ginger spice and bright citrus.

Accompanied by Rare Dry Gin & Tonic, Fresh Yuzu Gin & Soda and Bloody Shiraz Gin & Tonic, Four Pillars’ full RTD range is available at an RRP of $29.99 for a four-pack.

Distributor: Lion

Handpicked Wines unveils 2022 Single Vineyard and Collection vintages

Australian winemaker Handpicked Wines has released the 2022 vintages of its Single Vineyard and Collection ranges, comprising a selection of Pinot Noir and Chardonnay from its organically managed vineyards across key Australian wine regions.

Peter Dillon, Chief Winemaker, says: “Our Single Vineyard range shows the character of individual vineyards, while the Collection range showcases the character of each wine region as a whole through the varieties that they are most renowned for.

“Terroir is at the heart of these two ranges, so we take great care to nurture the sites, which helps us produce exceptional fruit. We carefully select the highest-performing pockets of grapes from the vineyards and handle them gently throughout the winemaking process.

“These 2022 release wines are a testament to over a decade of thoughtful stewardship, regenerative farming methods, and a deep respect for the land.”

The eight new vintage releases include premium expressions of the winemaker’s two flagship varieties from Mornington Peninsula, Yarra Valley, Tasmania.

Distributor: Handpicked Wines

Vok Beverages reveals a bold new contender in flavoured whisk(e)y

While flavoured whisk(e)y is no longer a niche, Vok Beverages hopes to lead the movement in Australia with the release of Real McCoy, a premium flavoured whiskey liqueur.

Designed to cater to the evolving tastes of modern whisk(e)y consumers, Real McCoy is positioned to capture the momentum of the flavoured whisk(e)y category, which is growing at three per cent year-on-year.

So far, the range includes two flavours, Salted Caramel and Buttered Popcorn. Bottled at a lighter ABV of 30 per cent, the two flavour expressions are available in both 700ml and 50ml formats for convenience.

Johann Einarson, Brand Manager at VOK Beverages, says: “Flavoured whiskey is no longer a trend – it’s an established, fast-growing category with enormous commercial potential.

“Real McCoy is a commercially-minded product built for today’s market – high-impact flavour innovation, competitive price point, and genuine versatility across retail and onpremise. It’s exactly what the category has been calling for.”

Distributor: Vok Beverages

Snapper Distillery joins Swift + Moore Beverages portfolio

Swift + Moore Beverages has taken over the Australian distribution of Whipper Snapper Distillery products, with the exception of West Australia.

Hailing from East Perth, Whipper Snapper Distillery has attracted global acclaim with its distinctive distilling process and use of West Australian grains. This year alone, the distillery was awarded Best Australian Corn Whiskey, Best Australian Rye Whiskey and Best Australian Wheat Whiskey at the World Whiskies Awards held in London.

Michael McShane, Principal and CEO at Swift + Moore Beverages, says: “With Whipper Snapper Distillery’s relentless pursuit to create the perfect Australian whisky, we are thrilled to be able to add such an exceptional range of whiskies to our portfolio.”

Alasdair Malloch Co- founder and Managing Director of Whipper Snapper Distillery, added: “Swift + Moore has a long history in the Australia market, and we see our partnership as a natural fit and look forward to continuing to build our presence in the Australia market.”

The distribution partnership is already effective, with all ranges distributed via major wholesalers and platforms.

Distributor: Swift + Moore Beverages

Coastal’s hard coconut water introduces new flavour

Australia’s first alcoholic coconut water has launched a new flavour with pink grapefruit joining the Coastal’s range.

The RTD is crafted with pure coconut water, real fruit juice with no added sugar and is mixed with triple-distilled gluten-free vodka, offering a naturally sweet taste with 43 calories per 100ml.

Coastal’s founder, Adam Benwell, says: “Our new pink grapefruit flavour adds a vibrant twist that’s perfect for laid-back winter drinks. We decided to go all in with 100 per cent coconut water, adding fruit juice to create a flavour range, and using pure rice vodka for the alcohol.”

“Those naturally occurring electrolyte salts enhance the fruit juice flavours and make the drink incredibly tasty and refreshing.”

Coastal’s said the recipe took nine months to fine tune and the company is proudly carbon neutral while also donating money to environmental charity 1% for the Oceans.

The pink grapefruit flavour adds to the pineapple and watermelon RTDs launched by Coastal’s in mid-2024, which are now stocked in more than 350 retailers across Australia.

Distributor: Direct, ALM, Paramount Liquor

Carlton Dry gets a rebrand

One of Australia’s most popular beers has rolled out a fresh visual brand identity. Carlton Dry is targeting a wider audience with the refresh while aiming to offer drinkers more opportunities to moderate with its 3.5 per cent offering.

Carlton-Asahi Beverages Marketing Manager, Jessica Johnson, said the branding paves the way for growth.

“The strategic decisions behind Co-Partnership’s work have given us not only a modern expression of Carlton Dry’s crisp, ultra smooth refreshment, but also the brand tools for a future of growth.”

Co-Partnership says the beer brand needed a contemporary evolution that would retain its easy-drinking relevance while appealing to a broader range of beer lovers.

“Designed to slot into modern social occasions from the pub to the barbecue, the new identity empowers the brand with cut-through consistency to engage consumers across physical and digital touchpoints,” it said.

Many of the brand elements have been retained, such as the horse head and typography while others have been refined to retain brand recognition and inject fresh energy, according to Co-Partnership.

“A key element of the refresh is the introduction of a brand lockup that integrates existing assets into a unifying emblem, one that can flex across products, formats and comms to enhance Carlton Dry’s distinctiveness at scale.”

Distributor: Carlton & United Breweries

Proof Drinks to distribute Finlandia in Australia

A new partnership between Finlandia and Proof Drinks Australia will see the company exclusively distribute the vodka in Australia.

Proof Drinks UK already distributes Finlandia, but the local deal will add to the Australian company’s stable of brands such as Monnet Cognac, Sunshine & Sons Gin and Cut Rum.

Proof Drinks Australia MD, Drew Doty, said partnership will continue to bring one of the world’s most iconic and premium vodka brands to Australian consumers.

“We are thrilled to be entering into this exciting partnership with Finlandia vodka, a brand that represents the perfect balance of quality and heritage,” Doty said.

“With its unparalleled taste and premium reputation, we are confident that Finlandia will continue to be a favourite among Australian vodka drinkers.”

Finlandia Vodka is crafted with pure glacial water and six-row barley in Finland and currently has annual production volumes of 2.7 million cases globally.

Distributor: Proof Drinks Australia

Bladnoch introduces two new single malts to Australian market

Scotland’s oldest privately-owned Scotch whisky distillery, Bladnoch, has unveiled two new single malt whiskies, Bladnoch 8 Year Old and Bladnoch 16 Year Old.

Matured in two different types of American oak red wine casks, Bladnoch 8 Year Old was bottled at 46.7 per ABV. The rich single malt has aromas of strawberries and cream with herbal pinecones, while the complex flavour profile presents flavours of strawberry jam, polished oak and nutmeg.

Also bottled at 46.7 per cent ABV, Bladnoch 16 Year Old was matured exclusively in oloroso sherry casks, offering hints of wood spices, raisins, sultanas and orange peel on the nose. Expertly handcrafted by Bladnoch Master Distiller Dr Nick Savage and his team, the whisky presents a palate of raisins, dried fruits, fruit cake, cinnamon and chocolate.

Bladnoch’s whiskies are now being rolled out globally as part of the distillery’s continued growth after it was acquired by David Prior in 2015 – who became the first Australian to own a Scotch whisky distillery.

Dating back to 1817, Bladnoch Distillery is one of the oldest single malt Scotch whisky producers in the world and is enjoying a bold revival.

Distributor: ALM Connect, Paramount and ILG

Innocent Bystander steps into bold new territory

Innocent Bystander is going beyond its Yarra Valley roots with the release of two new wines, Easy As Shiraz and Sauvignon Blanc, crafted from Victorian and Tasmanian grapes.

Innocent Bystander’s Winemaker Geoff Alexander says the new releases are a signal of the direction the brand is headed as it moves beyond its cellar door and aims for a broader future.

“Moving beyond the Yarra Valley doesn’t mean we’re abandoning our roots, it means we’re not limited by them. Great fruit exists across Australia, and these two wines are just the beginning.”

Designed to flip expectations of the classic red variety on its head, Easy as Shiraz is crafted from premium Heathcote Shiraz, offering flavours of juicy wild berries, soft tannins and a vanilla finish, and bottled at 10 per cent ABV.

The Tasmanian Sauvignon Blanc is a crisp and expressive wine crafted for everyday drinking, boasting zesty citrus, freshcut herbs and crisp acidity, with a higher ABV of 14 per cent. Distributor: Brown Family Wine Group

Coopers Dark Ale now in a can

Coopers has announced its fan-favourite Dark Ale will now be available in a can, responding to calls from beer lovers across the country.

The dark brew has only ever been sold in bottles and kegs; however, for a limited time, Coopers Dark Ale will be available nationwide in a brown 375ml can. It is the last remaining beer within the permanent portfolio of Australia’s largest independent family-owned brewery to be packaged in a can format.

Managing Director Michael Shearer says: “More and more fans have been asking for Dark Ale in a can to the point that it’s been our most requested new product development in the past 12 months.

“Coopers is always keen to hear from our fans, and we’re pleased to be able to meet this request, even if it is just for a limited time. Our brewers have trialled and tested the beer in the can format. It tastes and looks great so we’re confident it will be well received.”

The roasted and crystal malts in Coopers Dark Ale produce a deep amber brew, with tasting notes describing a rich, full-bodied flavour which delivers a generous mouthfeel with sufficient hop bitterness for a well-balanced smooth finish.

Distributor: Coopers

Turner Stillhouse blends Tasmanian distilling heritage with American influence

Turner Stillhouse has ushered Tasmanian whisky into a new chapter, releasing two distinctively Tasmanian Bourbonstyle whiskies – Rosevears Tasmanian Three Grain Whiskey and Rosevears Tasmanian Single Malt Whisky (Bourbon Cask Matured).

Rosevears Three Grain Whiskey is a unique Bourbon-style whiskey that blends the vision of American-born distillery owner Justin Turner with the influence of the Tasmanian distilling team to showcase the state’s unique terroir.

Rosevears Single Malt Whisky is made with 100 per cent Tasmanian malted barley and pure Tasmanian water, handmade in small batches and matured in American oak bourbon casks.

“We are the first distillery to produce a bourbon-style whiskey using 100 per cent pure Tasmanian water and grains (corn, rye and barley) and matured in large-format toasted and charred new American oak,” says Turner.

“Whisk(e)y is absolutely why I started the distillery. It’s my passion, and it’s exciting to see these whiskies finally coming to market, bringing something different and completely new. We’re really proud of them and can’t wait for our customers to discover their unique and unexpected qualities.”

The first batch of the new releases is limited to 500 bottles, each numbered, gift-boxed and handsi8gned by Turner and Lead Distillery Brett Coulson.

Distributor: Turner Stillhouse

Latest additions to De Bortoli’s One Line range

De Bortoli Wines’ One Line range is growing, now with the addition of two vibrant reds: One Line Tempranillo and One Line Sangiovese.

Crafted as a modern take on Rutherglen’s unique terroir, the range showcases the region’s natural strengths and character, with the 2024 vintage promising to be one of the standout vintages of the last 10 years.

One Line Sangiovese is a vibrant red with aromas of red berries, cherries, spices and hints of dried herbs. On the palate, wine offers balanced cherry strawberry flavours with integrated oak and a savoury finish.

One Line Tempranillo offers hints of crushed red fruits, dark berries, cherry compote and spice. Aged in older French and American oak, the wine has a softness and roundness on the palate, with mouth-filling grainy tannins and subtle tobacco.

Distributor: De Bortoli Wines

Tasmanian-born Kurio brings new depths to whisky world

Amber Lane releases new whisky

Amber Lane Distillery has launched its follow-up whisky to Silk Road with the release of Silk Lane, offering a similar flavour profile to its predecessor with dark sugar and spice notes.

Silk Lane comes at a lower ABV of 48 per cent, allowing to be more accessible at $149.

The distillery’s co-owner, Rod Berry, told National Liquor News the release has been eagerly awaited, and Silk Lane is a more gentle, creamy style of whisky.

“This was achieved by longer maturation and the addition of water to casks to bring down the strength slowly to the bottle strength,” he said. “The slow addition of water to the cask, a technique we have learned from the Cognac tradition, draws out more softness from the barrel

“With its rich, dark sugar and spice flavours, but at a more approachable strength, Silk Lane is sure to find a place on the shelves of whisky lovers everywhere.”

After spending almost 14 months in virgin American oak casks, the whisky underwent a secondary maturation period in Heaven Hill bourbon casks for three to four years.

Distributor: Amber Lane Distillery

Launched by the distilling team at Lark Distilling Co, Kurio is a new flavour-forward blended whisky that heroes local Tasmanian ingredients and the island’s creative spirit.

Kurio was developed by Lark’s Master Distiller, Chris Thomson, as a way of showcasing the distillery’s most innovative and successful flavour experiments, targeting new-to-whisky drinkers with spirits that are easy-going and accessible.

The first release in the Kurio line, Crimson Jam, blends a selection of single malt whiskies finished in Tasmanian cherry and sparkling wine-seasoned casks. The result is a full-flavoured blend with fruity notes and a richness enhanced by the use of native ingredients.

Thomson says: “We wanted to push the limits of flavour with Kurio. Tasmanian ingredients are incredible and the way we create as islanders is unique. Kurio is a celebration of both. Whisky for people who, like us, crave exciting and intriguing flavour experiences.

Distributor: Lark Distilling Co

Australian wine in the spotlight

Vinexpo Asia returned to Singapore for the first time since 2023, allowing Australian wineries to connect with the younger markets of Southeast Asia amidst global trade challenges,

From 27 to 29 May, exhibitors and international visitors gathered at Singapore’s Marina Bay Sands for Vinexpo Asia 2025. As the leading wine and spirit trade event in the Asia Pacific region, Vinexpo welcomed around 11,000 trade visitors from 70 countries along with approximately 1000 wine and spirit producers from 30 countries.

Over the three days, attendees explored a diverse global offer on the showroom floor while deepening their understanding of the southeast Asian market through more than 30 masterclasses, panels and tastings.

The expo got underway on the morning of Tuesday 28 May following a traditional lion dance and address from Vinexposium CEO Rodolphe Lameyse who noted the fast-paced evolution of the industry and its challenges, emphasising the value of shows like Vinexpo in facilitating growth in Asia.

“In Singapore, we stand out as the most exciting growth engine of the wine and spirit sectors. The young, fast-moving and fullof-promise businesses have demonstrated that we can adapt and grow quickly,” he said.

“That’s why Vinexposium and our Vinexpo events, we matter. It is not just where the market meets, it’s where the strategies are shaped.”

Interest in Australian wine remains high

Paul Turale, Marketing General Manager for Wine Australia, sat down with National Liquor News to discuss the show’s role in driving the success of Australian wines in emerging Southeast Asian markets and the impact of global uncertainties on producers.

Australian wine was broadly represented at this year’s expo with more than 60 wineries under the Australia pavilion, showcasing over 400 wines from 30 of the country’s 65 wine regions.

Turale’s overall assessment of Vinexpo 2025 was that with fewer crowds than anticipated, the focus for Australian producers was “quality over quantity” and delivering the key message of national diversity to potential buyers.

“Whether it’s because of economics or broader global trends –health, moderation, or wellness trends – alcohol generally is finding it more difficult to maintain growth.

“Where we have been strong historically is our diverse offering but also being a very engaging and accessible country – whether that be through style, through price point, or the suitability of products for a whole range of occasions,” said Turale.

Despite these challenges, Export and Marketing Consultant for Wines of Western Australia, Liz Mencel said she was pleased with the reception to Australian products and the level of consideration and engagement from buyers.

“There have been fewer people walking around, but the people that have come to the stand have stood and engaged for a long time. I think most people would agree, if you’ve set up a few good meetings and you’re prepared, then there is plenty of value in the business being done here.”

Handpicked Wines Chief Winemaker, Peter Dillion agreed also noting a sustained interest from buyers in the premium products that come from Australia.

“There’s been plenty of conversation about that premium side, which I think is exciting for us to see. There’s interest at the entry levels as always, but increasingly conversations about that higher end, which is fantastic.”

Winemaker and Chair of the Yarra Valley Wine Growers Association, Meg Brodtmann MW told National Liquor News that this relates to discretionary spending because of economic uncertainty.

writes Sienna Martyn.

“Australian wines aren’t cheap, generally, but I think people are spending a little bit more and drinking a little bit less, which suits us well.”

Global uncertainty impacts on wine producers

Despite the political challenges in recent years, Turale believes at this year’s expo, Chinese trade and consumers have continued to show their love for Australian wine.

The Wine Australia Export Report data released in March showed that in the 12 months since the tariffs were lifted in 2024, Australia exported 96 million litres of wine valued at $1.03bn to the Chinese market.

Asia Export Manager at Chateau Tanunda, Crystal Xie, told National Liquor News that despite the repaired relationship between the two markets, Chinese buyers are still feeling the effects of global trade tensions.

“The competition here is fierce. People are getting more cautious, because of the threat of USA tariffs and the trade war with China. For us it’s a challenge as European countries are adjusting their strategies to Asia,” she said.

“Chinese customers, like everyone, are really being careful about their spending. This year, people know the brands they want, they have a destination in mind and certain products.”

Turale agreed, adding this has emphasised the importance of market diversification into the emerging markets in the Asia pacific region. Exhibitors mentioned the growing opportunities for success in Thailand, Vietnam, Malaysia and Singapore.

“There’s a lot of uncertainty, whether it be from China or other parts of the world. It’s not just wine – it’s across all trade, and it’s impacting sentiment. I think we’re in a good place, but you never take anything for granted. We want to have Australian wine available to everyone, everywhere.”

“There is a view among the exhibitors that the wines we’re making out of Australia are probably the best we’ve ever made.”

To connect with these new markets, Brodtmann said education is essential.

“Many people don’t necessarily know how and when to drink wine because it’s not an established part of Southeast Asian culture. So, we have to help create that culture, show them how to use it. It doesn’t have to be intimidating. We don’t have to analyse the wine; we just need to enjoy it.”

Future prospects for Australian wine

Overall, Vinexpo 2025 was an excellent opportunity for Australian wineries to connect with emerging markets in southeast Asia, and share strategies for the sustained growth of international trade.

Above all concerns, Turale told National Liquor News that over the course of the expo, optimism for the future could be felt throughout the Wine Australia pavilion.

“There is a view among the exhibitors that the wines we’re making out of Australia are probably the best we’ve ever made. I think the styles continue to evolve to reflect market demand. And I think on that basis, the future is bright.”

Margaret Harris, General Manager International for Taylors Wines and Wakefield Wine, agreed with the positive sentiment coming from producers, which she says is the result of a clear vision and plan for the future in new markets.

“I think it’s just about making sure we’re tapping into the consumer mindset, putting the Asian consumer at the centre of our innovation. Not just making things that Australians would want but adapting our brand and our new product development for the Asian palate as well.”

Paul Turale, Wine Australia

Retail Drinks releases latest research report on retail liquor crime, safety and security

The

Retail Liquor Industry Safety & Security Report highlights concerning risks for liquor store workers and customers.

As part of our ongoing commitment to the responsible promotion, sale and supply of alcohol beverage products, and to making retail liquor stores safe, secure and respectful environments, Retail Drinks recently released its latest research report titled Retail Liquor Safety & Security

The aim of the research was to shed new light on security issues specific to liquor retailing, including the location, nature and frequency of incidents throughout Australia. Developed in partnership with Axon and Circana, the research considered survey feedback and insights from more than 1,000 retail liquor stores across all parts of the country, from store owners, staff and importantly, their customers.

The report’s key findings reveal that:

• 11 per cent of all customers had witnessed an incident.

• Almost 50 per cent of staff experience security incidents weekly or more.

• 40 per cent of customers have changed their shopping behaviour due to safety concerns.

• Only 47 per cent of security incidents are reported to police, with many citing low confidences in response outcomes.

• Most stores operate without the necessary security measures in place, largely due to prohibitive costs.

The research was completed against a backdrop of daily security incidents occurring across the country, with Victorian and Queensland liquor stores being the worst affected. Liquor is unfortunately one of the most stolen items across all of retail due to its portability, high value and ease of consumption.

Alarmingly, when asked about safety and security in their current store environment, 45 per cent of retail liquor store owners and staff said that they did not feel safe. Of these respondents, 11 per cent said that they felt unsafe, four per cent felt very unsafe and 30 per cent said they felt neither safe nor unsafe.

Critically, the research also examined responses from retail liquor store owners, staff and their customers when faced with a security incident. Interestingly, store owners and staff were more likely to confront the perpetrators, which more often escalated the incident. Moreover, a significant number of incidents were not being reported to police. This unfortunately means that official government statistics on crime in retail liquor stores are not a true indication of the actual problem, which is widespread, national, and getting worse.

When customers were asked about their responses to incidents, 40 per cent said they changed their behaviour, including shopping on different days or at a different

time of day, spending less time in the store, shifting to shopping online, or even not returning to that store at all.

The findings demonstrate a strong commercial need for store owners to prioritise security concerns as there is a strong likelihood that customers won’t come back.

Armed with this new data and insights, Retail Drinks is calling for three key steps at a state and territory government level to help address escalating liquor store crime.

Strengthen legal deterrents including mandatory sentences for repeat retail crime offenders.

Establish a government-funded program to help retailers install modern security measures like CCTV, duress alarms, and entry barriers.

Improve police engagement through prioritised incident reporting and faster response times.

Taken together, we believe this threepronged approach will make a real difference to the rates of retail liquor crime currently being experienced across the country. ■

Michael Waters Chief Executive Officer Retail Drinks Australia

DrinkWise makes its mark at Gather Round

DrinkWise returned to Adelaide in April, reminding footy fans about the importance of respectful alcohol consumption while embracing the excitement of Gather Round.

By Simon Strahan, CEO,

DrinkWise.

In April, DrinkWise returned to Adelaide for Gather Round, championing moderation and respect as nearly 270,000 fans attended nine AFL matches. DrinkWise partnered with the South Australian Government, South Australia Police, Adelaide Metro, Adelaide Oval and support services like 1800RESPECT, Men’s Referral Service and 13YARN.

South Australia Police Acting Assistant Commissioner John De Candia and AFL Brownlow medallist Gavin Wanganeen lent their voices to the ‘Always respect, always DrinkWise’ campaign, reminding local and visiting footy fans about moderating alcohol consumption and showing respect towards others.

Gavin Wanganeen, reflecting on the significance of the campaign, encouraged fans to embrace the excitement of Gather Round while keeping moderation in mind.

“We all love getting swept up in the excitement of a big game, especially during Gather Round. No one wants to miss a lastminute goal or a high-flying spectacle, so

if you’re choosing to have a drink, do it in moderation to ensure you and everyone around you can enjoy every moment,” he stated.

DrinkWise research shows that 89 per cent of footy fans drink responsibly at sporting events and 94 per cent believe excessive drinking can ruin the sporting experience for others. While these figures are encouraging, reminders remain essential for those who haven’t embraced the message. Fans at Gather Round encountered ‘Always respect, always DrinkWise’ reminders at every turn –stadium screens, outdoor billboards, posters in pubs and bottle shops, mobile messaging trucks, the baggage carousel at Adelaide Airport, in the Footy Record and on the free Footy Express train network. Mainstream media coverage across television, digital, print and radio, along with endorsements from AFL stars Patrick Dangerfield, Gavin Wanganeen, Ollie Wines and Reilly O’Brien, also helped ensure Gather Round was safe and memorable for everyone.

DrinkWise also teamed up with Adelaide Oval to include moderation and respect reminders at the iconic sporting venue. This partnership will see permanent reminder messages of moderation, respect and support at every event at the Oval – from AFL and cricket matches to concerts and more. Fans will continue to see these reminders on digital menu screens, digital beer taps and even on stickers at 120 public bar registers. This proactive approach ensures fans choosing to drink are supported to make responsible choices in real time.

Supported by AFL and NRL heavyweights and archrivals, state police forces, governments and support services, the ‘Always respect, always DrinkWise’ campaign continues to drive a cultural shift towards responsible consumption, for those choosing to drink. As the campaign moves into the NRL State of Origin series, governments, police, players, retailers, hotels and support services will again be supporting the message. ■

New Zealand Winegrowers’ commitment to sustainability

“Despite current turbulent global trade winds, the reputation of the New Zealand wine industry for highquality, distinctive, and sustainable wines remains a constant, and the industry is focused on protecting its hard-won reputation for generations to come.”

Catherine Wansink Australia Market Consultant New Zealand Winegrowers

The New Zealand wine industry remains committed to a sustainable future, a vision that industry leaders have been championing for more than 30 years. Despite current turbulent global trade winds, the reputation of the New Zealand wine industry for highquality, distinctive, and sustainable wines remains a constant, and the industry is focused on protecting its hard-won reputation for generations to come.

Recently released, the 2025 New Zealand Winegrowers Sustainability Report takes the pulse of the industry’s progress with sustainability. The report provides a compelling snapshot, highlighting empirical data collected from its members that are certified by Sustainable Winegrowing New Zealand (SWNZ) – encapsulating 98 per cent of vineyard area, and around 90 per cent of wine produced.

The measures are set against the industry’s sustainability goals: climate change, water, people, soil, waste, and plant protection.

“While we may be here for a short time, our impact can last longer than a lifetime. To our industry, sustainability means growing grapes and producing our world-famous wines in such a way that we can do so for generations to come,” says the report.

The report notes that climate change is the biggest long-term challenge facing the industry. The New Zealand Wine Roadmap to Net Zero 2050, released in 2024, highlights the need for change across key areas of the value chain to set the path to a net zero future.

Dr Edwin Massey, General Manager Sustainability says: “We can see from the data, that more of our members are implementing specific initiatives to minimise their carbon footprint.

“Once you start measuring your emissions, you can then make informed business decisions around future changes and investment.”

SWNZ members submit data on their greenhouse gas (GHG) emissions, and an individualised report is provided to each member, giving comparative data over time. In addition, there are also regional and national reports providing a macro benchmark for progress.

With the goal to be world leaders in water use and the protection of water quality, Massey says the report shows that “100 per cent of wineries and 92 per cent vineyards are optimising their water use through conservation and reduction”.

With 90 per cent of New Zealand wine currently exported, advancing sustainability through research is paramount to the future success of the industry. Bragato Research Institute (BRI) is a wholly-owned subsidiary of New Zealand Winegrowers and bridges the gap between science and industry, focusing on and delivering research that fills knowledge gaps specific to New Zealand’s current and future grape growing and winemaking needs.

The commitment to sustainability remains a key differentiator for New Zealand wine and is central to its premium brand proposition, and this report highlights the ongoing efforts by grape growers and winemakers in putting sustainability first. ■

Scan to read the 2025 Sustainability Report.

The 2025 New Zealand Winegrowers Sustainability Report provides a snapshot of the industry’s progress with sustainability, highlighting the ongoing efforts by grape growers and winemakers.

Wine Australia provides a domestic market update

Australia’s wine sector rebounded in 2024, with off-premise sales rising –driven by strong domestic wine performance in both value and volume.

The Australian wine sector is seeing signs of renewed energy, with off-premise wine sales climbing in both value and volume in 2024 – a welcome shift after flat or declining performance in 2023. According to Circana, the value of offpremise wine sales in Australia grew by four per cent in 2024, with volume increasing by three per cent. Notably, this growth is being driven by domestic wines, which saw a five per cent jump in value and four per cent in volume – outperforming imported wine sales, which remained flat in value with volume down two per cent.

There are nuances by category. Still wine increased by five per cent in value and contributed to 90 per cent of the market growth, with bottled red and white wines both up by four per cent. Sparkling wine sales grew by two per cent while fortified wines sales dropped by one per cent. White wine holds a 48 per cent value share of bottled still wine sales with red wine holding 45 per cent.

Sales of Shiraz rebounded, growing four per cent in 2024 after a slight decline in 2023, and increased its share of red bottled sales by a percentage point to 42 per cent. Cabernet Sauvignon sales also regained ground in 2024, up three per cent, maintaining second place among reds with an 18 per cent

“The Australian wine sector is seeing signs of renewed energy, with off-premise wine sales climbing in both value and volume in 2024 – a welcome shift after flat or declining performance in 2023.”

Peter Bailey Manager Market Insights Wine Australia

share of value. Pinot Noir sales grew for the second successive year, up by four per cent.

For bottled white wine, Pinot Grigio was the standout varietal surging 17 per cent in value, now with a 10 per cent value share of bottled still white wine sales, well below Sauvignon Blanc with 42 per cent and Chardonnay with 20 per cent. Sauvignon Blanc sales grew by two per cent and Chardonnay by 0.4 per cent. Off a smaller base (four per cent value share of bottled white wine sales), Riesling was also a strong performer in 2024, with sales value up 15 per cent.

Within the sparkling wine category, Prosecco and rosé performed strongly. Prosecco sales grew by 10 per cent in 2024 after jumping 17 per cent in 2023, increasing its share of sparkling wine sales from 16 per cent in 2022 to 20 per cent in 2024. Sparkling rosé has been on a similar trajectory, with sales up seven per cent in 2024, and its value share growing from 20 per cent in 2022 to 23 per cent in 2024.

These figures tell a positive story for Australian wine ahead of a new marketing campaign that Wine Australia is rolling out in August this year across the country. The campaign is designed to help the sector capitalise on this momentum, positioning Australian wine as the ideal choice for a broader range of alcoholconsumption occasions. ■

Things to watch out for in shopping centre leases

Shopping centre leases offer growth opportunities, but they also carry risks. Thorough due diligence, legal advice, and careful negotiation can help prevent costly financial and operational issues, writes Marinna Idas, Principal, eLease Lawyers.

Shopping centre leases can be highly advantageous for businesses looking to tap into high foot traffic and established consumer bases. However, these leases often come with complex terms and conditions that can create unexpected financial or operational burdens for tenants. Understanding potential pitfalls is critical to avoiding costly mistakes.

1.

Hidden costs and outgoings

Shopping centre tenants are typically required to contribute to the centre’s operational costs, known as ‘outgoings’. These include expenses for rates, taxes, insurance, maintenance, marketing, and more. Your lawyer should negotiate limits on certain outgoings, such as marketing levies or land tax, to avoid escalating costs over time.

Landlords must provide tenants with a disclosure statement outlining the applicable outgoings. However, it is crucial to scrutinise these figures for accuracy and reasonableness.

2. Make-good obligations

At the end of the lease, tenants are often required to ‘make-good’ the premises. This means returning the property as stipulated in the lease, which can include:

• Repainting walls

• Removing fit-outs, furniture, or signage

• Making alterations to restore the premises, even if wear and tear occurred through ordinary business operations.

Ensure any make-good clause is clearly defined and negotiate reasonable limits on what is required to limit costs.

3. Rent and rent review

Rent structures and escalation clauses are common pitfalls for shopping centre leases. Key aspects to review include:

• Rent review methods: These could be based on fixed annual increases, the Consumer Price Index, or market rent reviews. Market reviews, in particular, can lead to unpredictable increases if the market value of the centre rises sharply.

• Turnover rent clauses: Some landlords charge additional rent based on a percentage of the tenant’s gross sales. Carefully assess whether online sales are included, as this could inflate rent unfairly.

4. Relocation clauses

Many shopping centre leases contain relocation clauses, permitting the landlord to move the tenant to an alternative location within the centre. This could be required due to redevelopment, renovations, or a reshuffle of tenant placements. Risks of relocation clauses include:

• Loss of revenue during downtime caused by relocating.

• Poor visibility or reduced foot traffic in the new location.

While the legislation requires landlords to reimburse reasonable relocation costs, it does not cover lost profits or additional operational disruptions. Tenants should

negotiate relocation clauses to limit their scope and impact.

5. Exclusivity issues

Shopping centres aim to attract a diverse range of retailers, but some leases may not exclude other similar businesses from operating nearby, which may negatively impact your business.

6. Trading hours

These leases typically specify core trading hours that tenants must abide by. While these hours provide uniformity within the centre, they could pose challenges if these hours do not suit your business.

7. Fit-out and design guidelines

Shopping centres often impose strict requirements for fit-outs to ensure aesthetic uniformity and high-quality presentation, which may increase tenant fit-out costs. Additionally, costs associated with obtaining approval from the landlord are generally required.

To conclude, while shopping centre leases offer significant opportunities to scale your retail operations, they are fraught with potential risks if not managed carefully. To minimise pitfalls, tenants should engage in thorough due diligence, scrutinise all terms of the lease agreement, and seek legal advice to negotiate favourable terms. This preparatory work can safeguard your business from unexpected costs and operational difficulties, ensuring a smoother leasing experience. ■

Four Wall Syndrome

Peter Hall explores how retail familiarity can blind managers to customer experience inside their own stores.

I’ve discussed the Four Wall Syndrome phenomenon many times with clients, and it always becomes an item for conversation in my training workshops. It comes about any time a retail manager is considering how a customer sees their store.

The immediate response is always; “Well I will know, I spend enough time in-store.” But unfortunately, the opposite is true. It’s the hours spent in-store that stop us from seeing our business as customers do and thereby reduces our effectiveness as a retail manager – hence the ‘Four Wall Syndrome’.